760

Daniel Adaji

Despite the Nigerian Education Loan Fund (NELFUND) disbursing over N53bn to students since May 2024, many beneficiaries say they are yet to receive the funds, sparking outrage and allegations of fraud against universities and banks.

“I have raised enough flag approved since July 2024, and to date, I haven’t received any,” complained @Chiller30BG on X (formerly Twitter).

“According to the updated portal, I should collect the 11th of every month starting from April. Today is the 19th and nothing,” he said.

This frustration is echoed across Nigeria’s online spaces, as students allege that their institutions are either shortchanging them or withholding disbursements altogether.

“The same issue is happening at Gombe State University. The amount approved by NELFUND is not the amount refunded by the school,” wrote @abkadam01829.

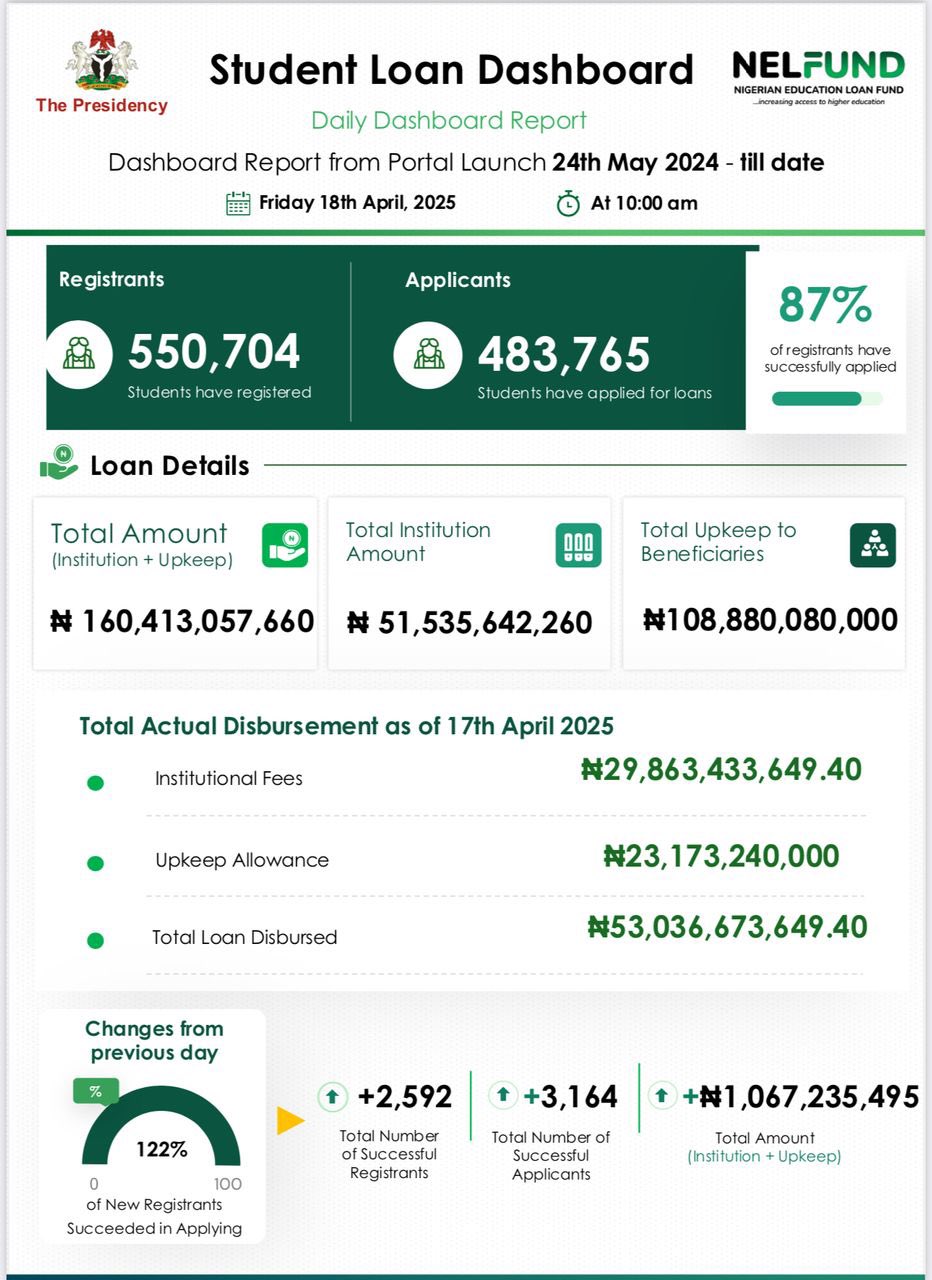

Official figures obtained by Pointblank News from NELFUND’s portal, last updated April 18, 2025, show that 550,704 students have registered, with 483,765 successful applicants—an 87 per cent application success rate. NELFUND claims it has disbursed N53.03bn, allocating N29.86bn for institutional fees and N23.17bn as student upkeep allowances.

However, these disbursements remain invisible to many students. On April 17 alone, NELFUND reported 2,592 new registrants, 3,164 successful applications, and N1.06bn in approved loans—yet social media is awash with stories of students still awaiting funds approved months ago.

Pointblank News gathered that parents are also stepping in to cover gaps.

“When I realized that you don’t have any intention to pay my child’s school fees I just paid his school fees and moved on,” wrote @Abuleenah2020. “You are not sincere about this scheme. You are playing politics.”

Allegations of mismanagement intensified after revelations from the National Orientation Agency (NOA). According to NOA Director General, Mallam Lanre Issa-Onilu, some universities and banks colluded to withhold student loan funds or failed to notify students of disbursements.

NELFUND Managing Director, Mr. Akintunde Sawyerr, confirmed the development, saying, “Some institutions have received student loan disbursements directly into their accounts yet neglect to inform the affected students or record the payments.”

Nigerians are demanding transparency. “Please ask the Management of Ahmadu Bello University the reason why they are refunding their students 12K, 9K or 18K instead of 89,000 approved by NELFUND as institution fees?” asked @NpowerNatlBody.

Another user suggested, “It will be better if NELFUND sends the institution fee to the student… let the student go and pay.”

The public is also calling for full disclosure.

“@NELFUND should publish the names. Or open a dedicated website where students can check the status of their loans,” tweeted @Diekololaoluwa.

Calls for accountability continue to mount: “Send one Vice Chancellor and his Bursar to prison and you’ve cured months of unnecessary headaches,” declared @truebenny001.

The NOA has now tasked its state directorates with gathering more feedback nationwide, pledging to identify and sanction offending institutions and banks. While some Nigerians commend the agency’s efforts, many believe stronger enforcement is overdue.

As daily disbursements rise and official dashboards paint a picture of progress, thousands of Nigerian students are still waiting—wondering when or if the loans will ever arrive.