693

Daniel Adaji

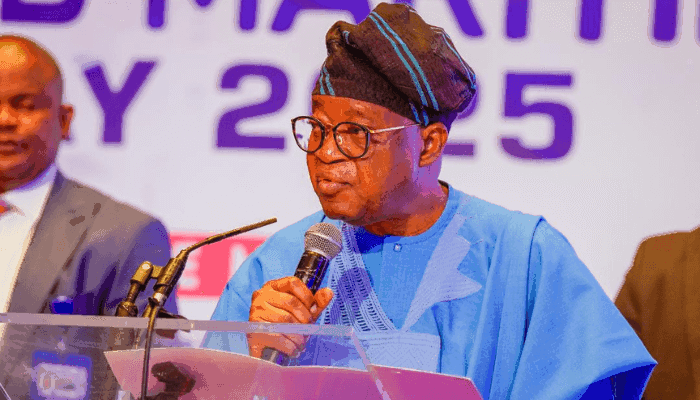

The Minister of Marine and Blue Economy, Adegboyega Oyetola, has warned that Nigeria’s marine and blue economy cannot achieve its full potential without sustainable financing.

He stressed that the nation risks leaving vast marine resources underutilised unless innovative funding structures are urgently put in place.

Oyetola made the call in a statement on Saturday following the third Quarter Citizens’ and Stakeholders’ Engagement of the Ministry and its agencies held in Lagos recently.

Addressing industry leaders, policymakers, investors and interest groups, he said finance is the decisive factor in translating the government’s policy vision into measurable impact.

The Minister described the theme of the event, “From Policy to Impact: Finance is Key,” as both timely and urgent. He reminded participants that the Federal Executive Council had, in May 2025, approved Nigeria’s first-ever National Policy on Marine and Blue Economy, which provides a clear roadmap for growth. However, he noted that the next step is mobilising capital.

According to him, the new policy covers shipping, fisheries and aquaculture, marine tourism, coastal infrastructure, renewable energy, and ocean research. But “vision without financing remains no more than a dream.”

He added that government cannot alone bear the heavy responsibility of modernising ports, sustaining maritime security, expanding aquaculture, or building climate-resilient infrastructure. Instead, he urged innovative partnerships, international financing mechanisms and strong private sector engagement.

Highlighting the ministry’s track record, Oyetola recalled that in the first quarter of 2025, the Central Results Delivery Coordination Unit awarded the Ministry a performance score of 96 per cent.

In 2024, the Presidential Enabling Business Environment Council also named it the best performing ministry. He said these results show government’s ability to deliver but emphasised that scaling up requires unlocking greater resources.

He pointed to financing-backed successes, including Nigeria’s piracy-free record in the Gulf of Guinea for more than three years, achieved through investments in the Deep Blue Project.

He also noted the rehabilitation of Lagos ports, which is attracting larger vessels, cutting turnaround time, and creating jobs. Consultations with fisheries associations, he said, are driving aquaculture expansion, fish harbour development, and satellite monitoring, contributing to a nearly 20 per cent rise in non-oil exports in the first half of the year.

“Distinguished stakeholders and partners, let us be clear: the Marine and Blue Economy is not solely a government agenda — it is a shared prosperity project. Finance is the lever that will attract long-term private capital; align our practices with global standards in PPPs, bonds, and blended finance, and ensure every stakeholder initiative complements the 10-Year National Policy for maximum impact,” Oyetola said.

He stressed that Nigeria’s path from policy to impact requires aligning ambition with resources, strategy with execution, and vision with impact.

“With collective commitment and innovative financing,” he said, “Nigeria is well placed to secure leadership in Africa’s marine and blue economy and to generate the prosperity, jobs and environmental resilience that its citizens deserve.”

The Permanent Secretary of the Ministry, Olufemi Oloruntola, also delivered a technical presentation titled “Imperatives of Public Investment for Marine and Blue Economy Development.”

He argued that public investment is vital seed capital to de-risk private sector involvement, strengthen regulatory institutions, and align national priorities with long-term growth.

Oloruntola warned that current budget allocations are grossly inadequate for capital-intensive projects such as port modernisation, maritime security, fisheries, tourism and renewable energy. He therefore called for a dedicated Blue Economy Fund, stronger public–private partnerships, and the use of blue bonds, green financing and multilateral support.

He outlined opportunities for Nigeria to exploit, including modernisation of seaports and inland waterways, support for indigenous shipping lines, fisheries and aquaculture expansion, development of cruise terminals and eco-tourism infrastructure, and investment in marine biotechnology and renewable energy.

With the right financing structure, he said, Nigeria could tap into over $1.5 trillion in global blue economy opportunities by 2030, creating millions of jobs and sustainable livelihoods for coastal communities.

Also at the event, Jude Chiemeka, Chief Executive Officer of Nigerian Exchange Limited, presented a paper titled “Marine and Blue Economy Development: Alternative Sustainable Financing Option.”

He underscored the capital market’s role in raising long-term funds for projects through sustainability-linked loans, blended finance, and impact investments.

The Lagos engagement drew participants from maritime associations, financial institutions, civil society, and other groups, all underscoring the consensus that the marine and blue economy is central to Nigeria’s diversification agenda.