Some shareholders in mobile giant MTN syphoned $7.8 billion in eight days through manipulation of shares after listing the company at the Nigerian Stock Exchange.

The massive fraud, Pointblanknews.com gathered, took place between May 16, 2019 (when MTN listed on the Stock Exchange) and May 24, 2019.

The alleged fraudsters, called A list shareholders, through fraudulent share manipulation pocketed $7.8billion with the connivance of top echelon of the Nigeria Stock Exchange and Securities and Exchange Commission, SEC.

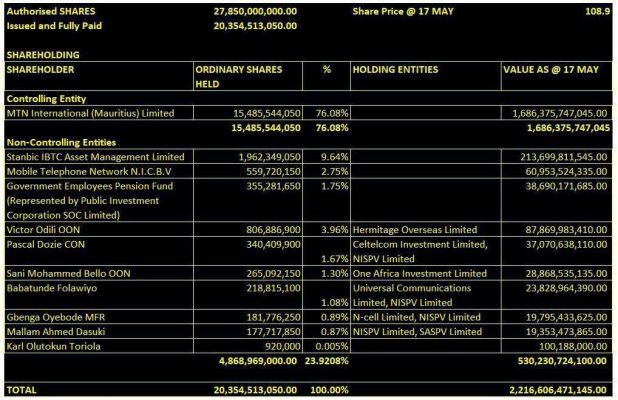

Some of the A listers fingered in the shares racket are Pascal Dozie, Sani Mohammed Bello, Babatunde Folawiyo, Gbenga Oyebode, Ahmed Dasuki, Victor Odili.

Institutions like Access Bank, Coronation Merchant Bank are also fingered in the MTN Stock Fraud.

Investigations by Pointblanknews.com revealed that the fraudsters were allegedly basically using those banks to trade the MTN stock amongst themselves.

It was learnt that they manipulated and traded MTN shares among themselves using the Co-founders of Access Bank, Aigboje Aig-Imoukhuede and Herbert Wigwe.

While Aig-Imoukhuede was former Group Managing Director and Chief Executive Officer of Access Bank, he is also the promoters of Coronation Merchant Bank Limited and Chairman, Board of Trustees of the Financial Market Dealers Association.

Wigwe is currently CEO and Group managing director of Access Bank plc.

All the other shareholders have interests in Access and Coronation Merchant Bank and so they pledged their shares from MTN to the banks.

It was gathered that since May 16 when MTN Nigeria listed in the Nigeria stock exchange, its stock jumped 41%, closing at 140 naira per share on Friday, giving the company a market capitalisation of 2.8 trillion naira ($7.8 billion).

Subsequently, MTN stopped paying dividends at this point the shareholders had started manipulating MTN Shares using Access Bank and Coronation Merchant Bank.

They started moving the shares around and the prices started going up with the backing of Aig Imoukuede and Wigwe.

A source involved in the investigation told Pointblanknews.com that “Those shareholders hoarded the MTN share, kept it among themselves after listing in NSE. They were trading the share among themselves and once the price goes up, they now take it to the public. It is a white collar crime. It is called Security Fraud.”

But stockbrokers sensed the fraud when the shares started going up. They wrote a petition to the Economic and Financial Crimes Commission (EFCC) which stormed MTN’s office in Lagos last Friday.

MTN, according to a contractor who confided in Pointblanknews, is owing it and 56 other Nigerian sub-contractors over N1 billion since 2010.

It was however gathered that four MTN directors had been quizzed alongside it’s chairman Pascal Dozie. Others quizzed are Gbenga Oyebode, Tunde Folawiyo, Ahmad Faroukh and Colonel Sani Bello.

Recall that the Senate had on Tuesday began a probe into the allegation that MTN Nigeria had repatriated $13.9bn from Nigeria to other countries between 2006 and now.

A member of the Senate representing Kogi-West Senatorial District, Dino Melaye, while moving a motion based on the ‘Unscrupulous Violation of the Foreign Exchange (Monitoring and Miscellaneous) Act’, alleged that MTN illegally repatriated the amount out of the country through its bankers.

The bankers, according to him, are Stanbic IBTC, which allegedly helped the firm to transfer $4.87bn; Standard Chartered Bank, $5.72bn; Citi Bank, $2.98bn; and Diamond Bank, $0.35bn.

“The Senate observes that MTN did not request for the Certificate of Capital Importation from its bankers, Standard Chartered Bank, within the regulatory period of 24 hours of the inflow. The Senate observes also that the CBN was not notified of this inflow by Standard Chartered Bank within 48 hours of receipt and conversion of the proceeds to naira as required by regulation.”

However, MTN deny any wrong doing. In a statement signed by Uto Ukpanah, company Secretary, the Telecom giant said they received all required approvals before listing at the NSE.

He reiterated MTN’s commitment to due process, assuring that it would comply and cooperate with the EFCC investigations.

Profile of the manipulators..

Pascal Dozie

Value of Shares: $102 million

Pascal Dozie is the founder of Diamond Bank, a commercial bank which recently merged with Access Bank to create one of Nigeria’s largest financial institutions. His Family Office, Kunoch Limited has investments in hotels, financial services and energy in Nigeria. Dozie owns 340,409,900 shares or 1.67% of MTN Nigeria, a stake currently valued at N37.07 billion ($102 million).

Sani Mohammed Bello

Value of Shares: $80.1 million

Sani Bello is the founder of Amni International Petroleum Development Co., a Nigerian oil exploration company. He owns 265,092,150 shares or 1.3% of MTN Nigeria, a stake currently valued at N28.87 billion ($80.1 million).

Babatunde Folawiyo

Value of Shares: $66.1 million

Tunde Folawiyo is the managing director of the Yinka Folawiyo Group, a conglomerate with interests in energy, agriculture, shipping, real estate and engineering. He owns 218,815,100 shares or 1.07% of MTN Nigeria, a shareholding that is worth N23.83 billion ($66.1 million).

Gbenga Oyebode

Value of Shares: $55 million

One of Nigeria’s most renowned commercial lawyers, Gbenga Oyebode is a founder and Managing Partner of Aluko & Oyebode- a successful corporate and commercial law firm in Nigeria. He owns 181,776,250 shares or 0.89% of MTN Nigeria, a stake that’s currently worth N19.8 billion ($55 million).

Ahmed Dasuki

Value of Shares: $53.75 million

He is the founder of Quaditect Consultants. He is also the Chairman of Drill Masters Africa, the largest indigenous exploration drilling company in Ghana, the Chairman and Chief Executive Officer of XEX Limited Nigeria and the Chairman of Interglobal Limited, a leading IT company in Nigeria. He owns 152,717,850 shares or 0.75%, currently worth N19.35 billion ($53.75 million).