827

By Myke Agunwa

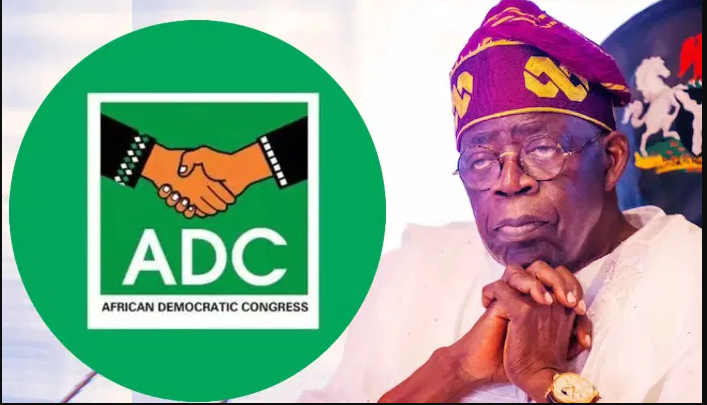

The African Democratic Congress (ADC) has criticized the Federal Government’s fresh request of ₦1.15 trillion in domestic borrowing, accusing President Bola Tinubu of fiscal recklessness and policy inconsistency.

Since taking office in May 2023, the Tinubu government has borrowed over ₦40 trillion, pushing Nigeria’s total public debt stock to ₦152.4 trillion as of June 2025, according to verified figures from the Debt Management Office (DMO). This includes ₦80.55 trillion in domestic debt and ₦71.85 trillion in external obligations—figures that could rise to ₦193 trillion if all pending loan requests for 2025 are approved.

The President Tinubu’s government relied heavily on borrowing to finance fiscal deficits since taking office in May 2023. The 2025 budget framework projects a deficit of ₦17.7 trillion, about 4.3 percent of GDP will largely to be financed through domestic and external loans.

In a statement signed by its National Publicity Secretary, Mallam Bolaji Abdullahi, the party said the new borrowing contradicts Tinubu’s earlier claims that Nigeria had met and surpassed its non-oil revenue targets, generating ₦20.59 trillion by August 2025.

The party described the government’s new borrowing as “borrowing against its own words,” saying it exposes the contradictions in the administration’s fiscal policy and deepens Nigeria’s debt crisis without offering meaningful relief to struggling citizens.

“Only a few months ago, the President declared that Nigeria had achieved record revenue performance and that domestic borrowing would be phased out. Yet here we are again, with another ₦1.15 trillion loan request. This is fiscal recklessness wrapped in propaganda,” the statement said.

Abdullahi said the Tinubu administration’s borrowing spree “betrays a worsening case of economic policy schizophrenia,” where government officials make conflicting statements about revenue performance and fiscal prudence while pushing new debt approvals through the National Assembly.

“You cannot say your house is in order and still borrow to stop the roof from collapsing,” the ADC said. “A government that claims to have achieved record revenue should not be piling up record debts.”

The party further accused the APC-led National Assembly of complicity for approving the loans “without due scrutiny,” adding that the move was “insensitive” at a time when Nigerians are battling severe hardship.

The ADC also faulted official government data claiming inflation had dropped to 18.02 percent and food inflation to 16.87 percent in September 2025, saying the figures did not reflect the reality in the markets.

“Make no mistake, Nigerians are not experiencing statistical relief, they are experiencing economic suffocation,” the statement said.

The party called for an immediate freeze on non-essential loan approvals, full disclosure of all 2025 revenue inflows and debt disbursements, and an independent audit of the government’s non-oil revenue claims. It also urged the Tinubu administration to introduce a legally binding debt ceiling to prevent “continued abuse of the national purse.”

“We cannot borrow our way out of a crisis caused by economic incompetence,” the ADC warned.

Recall that in August 2025, the President assured Nigerians that improved non-oil revenues from customs, tax reforms, and digital remittances had boosted government finances. He also pledged to reduce reliance on borrowing by improving fiscal discipline. However, the latest loan request, analysts say, contradicts that position.

Economic experts have expressed growing concern over Nigeria’s rising debt profile, particularly its cost of servicing. The World Bank and IMF have both warned that Nigeria’s debt service-to-revenue ratio—estimated at over 80 percent in 2025—poses a significant threat to fiscal sustainability.

Pages: 1 2