670

Daniel Adaji

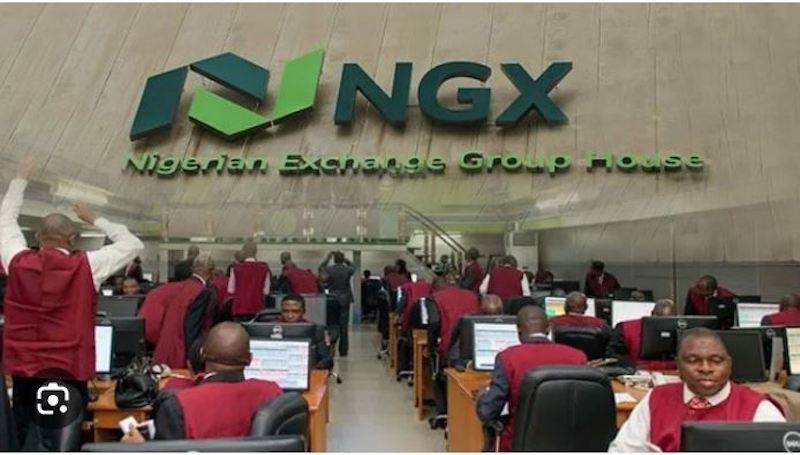

The Nigerian Exchange Group (NGX) Banking Index fell by 2.72 per cent on April 11, 2025, while the Insurance Index posted a modest gain, highlighting a growing divergence between the two key financial sub-sectors.

Official NGX data obtained by Pointblank News on Saturday showed the Banking Index dropped to 851.59 points from 875.38 on April 10. In contrast, the Insurance Index rose to 258.82 points, up 0.73 per cent from 256.94 the previous day.

The broader trend over the past month reinforces this contrast. Since March 11, the Banking Index has declined by 138.96 points, or 14.03 per cent, from 990.55 points. Meanwhile, the Insurance Index has climbed 12.07 per cent over the same period, rising from 230.95 points.

The NGX Banking Index reflects the performance of major banking stocks on the Nigerian Exchange, while the Insurance Index tracks listed insurance firms. These movements mirror investor sentiment, sectoral expectations, and broader macroeconomic conditions.

Analysts attribute the sustained decline in banking stocks to concerns over monetary tightening, foreign exchange volatility, and rising non-performing loans.

Meanwhile, renewed investor interest in insurance stocks is linked to the sector’s relative stability, low valuations, and anticipated gains from regulatory reforms aimed at boosting insurance penetration and capital adequacy.

The diverging performance suggests a shift in investor focus from banking to insurance.

Market watchers note this trend could continue if insurance companies maintain earnings resilience amid Nigeria’s evolving financial environment.