501

By Tracy Moses

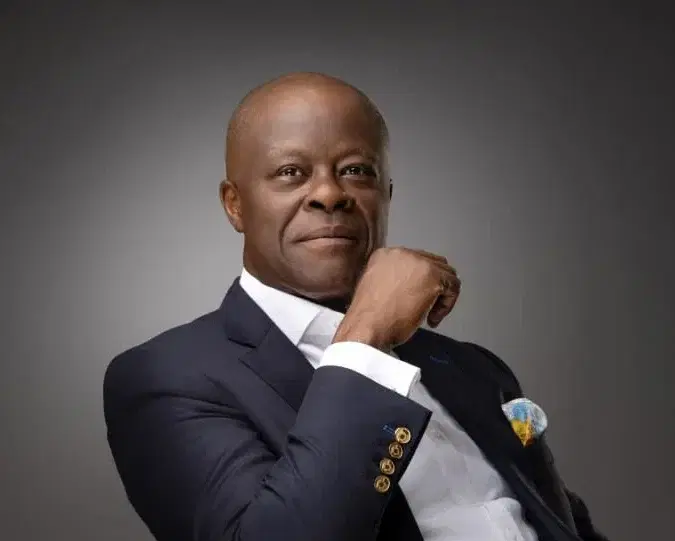

The Minister of Finance and Coordinating Minister of the Economy, Mr. Wale Edun, has reiterated the strategic role of Nigeria’s capital market in propelling the country toward its target of becoming a $1 trillion economy.

Speaking during the Capital Market Committee (CMC) meeting, on Monday Edun, represented by the Minister of State for Finance, Dr. Doris Uzoka-Anite, noted that the market has experienced a major shift since 2015, marked by improved governance, innovative financial products, a more robust regulatory environment, and increased investor engagement.

He credited the Capital Market Master Plan (2015-2025) for its instrumental role in expanding the market’s economic footprint, enhancing market sophistication, and improving global competitiveness.

According to Edun, the updated master plan focuses on five critical pillars: digital transformation, innovation, sustainable practices, inclusive participation, and capital formation, all aligned with Nigeria’s broader economic reforms.

He further noted that the recently enacted Investment and Securities Act 2025 modernizes the legal landscape, strengthens enforcement protocols, and brings clarity to emerging sectors like crowdfunding and digital assets.

Edun said the Act would bolster market depth and ensure consistent regulatory oversight. He also emphasized government support for private sector innovation through policies that foster a fair, transparent business environment.

He added that the capital market is not only a hub for fundraising but also a catalyst for wealth generation, economic integration, and long-term national stability.

The Minister revealed that Nigeria’s economy recorded its strongest GDP growth in over ten years in 2024, buoyed by an exceptional fourth quarter and an improved fiscal environment, achievements partly driven by capital market reforms and SEC’s alignment with global standards such as the ISSB through the IOSCO GBMC network.

In his remarks, Director-General of the Securities and Exchange Commission (SEC), Dr. Emomotimi Agama, reaffirmed the Commission’s commitment to regulatory excellence and deepening capital market development.

Agama described the passage of the ISA 2025 as a turning point for the Nigerian capital market. He outlined SEC’s plans to broaden stakeholder engagement, ensure full awareness of the new law, and spur innovation and compliance within the ecosystem.

He stressed the need to rebuild investor trust, provide timely redress for grievances, and foster inclusive wealth creation opportunities for Nigerians.

According to Agama, a dedicated implementation team has been formed to review every aspect of the new legislation, while a sensitization unit has also been inaugurated. In addition, a podcast series has been launched to demystify ISA 2025 for the general public.

He highlighted the impressive market performance in 2024, with the NGX All-Share Index gaining 37.65% and total market capitalization rising by 53.39%. He credited this momentum to reforms geared toward improving regulatory efficiency, market transparency, and investor protection.

Agama stressed SEC’s commitment to promoting financial literacy and expanding access to the market, especially among women, youth, and rural communities. He also spotlighted the Commission’s tech-forward initiatives, including a new e-survey designed to track digital adoption in the sector.