Benchmark indices for the stock market at the weekend showed average return of 4.52 per cent for the October 2021, strengthening the outlook for a second positive consecutive yearly return for the market.

The average year-to-date return for the market now stands at 4.39 per cent compared with negative returns of -0.12 per cent and 5.87 per cent in September and June.

The seven-week consecutive rally at the stock market was driven primarily by the third quarter earnings, with investors taking positions ahead of earnings release and responding to earnings reports.

Extant rules at the stock market require quoted companies to submit their quarterly report not later than 30 days after the end of the relevant period. Most quoted companies use the Gregorian calendar as their business year, thus the deadline for submission of financial statements for the third quarter ended September 30, 2021 is October 30, 2021.

Earnings reports by the highly influential; large to mid-cap companies that drive activities at the stock market show a largely steady outlook for Nigerian equities, fuelling a bargain-hunting that started earlier in anticipation of the earnings release.

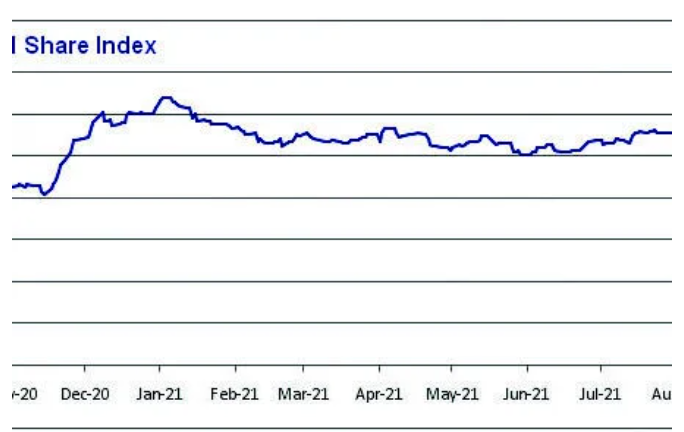

The All Share Index (ASI) – a common value-based index that tracks all share prices at the Nigerian Exchange (NGX), closed weekend at 42,038.60 points as against 40,221.17 points recorded as the opening index for the month, representing an average return of 4.52 per cent. The ASI, which is accepted as the sovereign equities index for the market, had opened 2021 at 40,270.72 points.

The market stumbled through a scare in the first half with the benchmark index down at 37, 907.28 points, leaving investors with net loss of 5.87 per cent or N1.24 trillion by the end of first half. However, steady rally in the third quarter boosted investors with average return of 6.10 per cent or N1.2 trillion for the three-month period.

The performance in October represents 77.3 per cent improvement over the return in September 2021 when the ASI posted average return of 2.55 per cent.

Aggregate market value of all quoted equities at the NGX closed weekend at N21.938 trillion as against the opening value of N20.956 trillion for the month, representing an increase of N982 billion or 4.68 per cent. The difference between the ASI return and on-the-face value market capitalisation was due to unadjusted effect of new listings during the month, including the listing by introduction of the NGX Group. Equities had opened 2021 with total market capitalisation of N21.057 trillion.

Most analysts remained optimistic on the outlook for the Nigerian equities.

Analysts at Cordros Securities said they expected “positive reaction to the flurry of earnings” released tin recent period as investors rotate their portfolio towards dividend-paying stocks ahead of 2021 financial year dividend declarations.

Analysts were however cautious that sustained gains in the past seven weeks could stoke profit-taking activities as some speculative investors seek to cash out on the gains.

“Notwithstanding, we reiterate the need for positioning in only fundamentally sound stocks as the weak macro environment remains a significant headwind for corporate earnings,” Cordros Securities stated.